Financial Advisor Russ Jalbert Breaks Down the ABC’s of Mutual Fund Costs

Southfield, MI. – It’s always good to know what you are paying for and when it comes to mutual fund cost analysis that is easier said then done. Russ Jalbert advises about how to determine how much you are paying to have your money managed for you. In an age of high tech gadgets, you’d assume tracking this would be easier but it’s not.

So here’s a quick tutorial on how mutual fund costs add up and how you can do some homework for yourself.

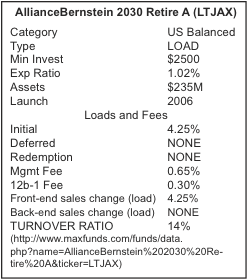

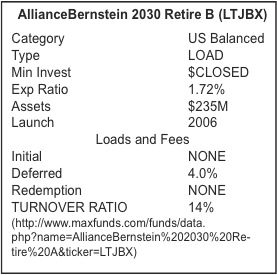

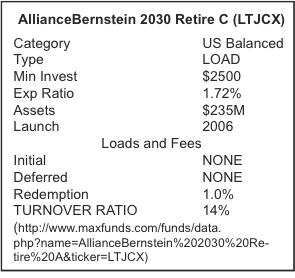

In the boxes below, you’ll see three versions of the same mutual fund: the Alliance Bernstein 2030 Retirement fund. You’ll see there are three different purchase options.

Let’s take a look at the costs associated with owning the Alliance Bernstein 2030 A share version.

There is an initial load of 4.25% which means if you buy this fund there is a built in cost of $425 per $10,000 purchased – so on a twenty thousand dollar fund purchase you’d pay a commission of $850 – so, your initial $20,000 on day one would put $19,150 to work for you. Larger investments often get “discounted” through breakpoint discounts; so the larger the investment the smaller percentage fee. There is also an on-going cost in the .65% management fee and the .30% 12b-1 marketing fee – so when you add it up, it’s a little less than 1% on-going (actually, .95%).

So, is B better? Well, you’ll see there is still a sales charge. It is just deferred, and if you wait long enough it’ll go away – so, in B share funds the fee is more of an early redemption fee or a “back-out” fee. These are often marketed as no-load funds but that is an inappropriate description plus you’ll see the on-going management fee is significantly higher at 1.72% which is a .77% higher annual cost. After the deferred sales charge period the B share converts into an A share and the costs reduce to the A share management fee schedule.

So, is C the right choice? Again, you’ll see the higher expense ratio and a redemption fee of 1%. These are often marketed as “advisors shares” as the advisor typically has a “trail” commission coming from the fund for acting as the advisor. C shares were designed for a shorter duration investment.

How to choose the right fund? “Well there’s more to it than share class – a lot more,” said Russ Jalbert, President of Jalbert Financial Group. “Mutual funds struggle with the strain of forced diversification and the drain of redemption both of which makes tax management difficult. A fund manager’s decision to sell for diversification purposes or to get money together for investors cashing out affects your tax bill – in 2000, the tax bill to American Investors during the “hot market” was $19.8 BILLION Dollars” (http://www.sec.gov/news/speech/spch491.htm.).

The decision to invest and where to invest is a difficult one, and, all too often, retirees and those seeking retirement make purchases for all the wrong reasons – like: past performance, a “hot” tip or advice from an unreliable source (like the internet).

An ideal situation is when you find an advisor you can trust; who’ll tell you straight what a reasonable expectation is, and, who speaks enough about safety that you are comfortable not just with the return on your money but the actual future return of your money. Slow and steady seems a logical way to win the race to a secure retirement.

For more information on how Russ Jalbert can help, please visit www.jalbertfinancial.com.

For media inquiries only, please contact Jenn Horner at [email protected].

About Russ Jalbert:

Russ Jalbert, CFP, has been a top financial planner for nearly four decades. During that time, he played an active role in the Reagan Administration and amassed an impressive list of accolades.

America’s ‘Dean of Financial Planning,’ Jalbert now points his clients to the solace of much safer products and approaches, and his record speaks for itself. When the market began its ascent in 2003, Jalbert’s clients were enjoying returns of five to seven percent, growing steadily but not as fast as the market from 2003 to 2007. When the market plummeted in 2008, losing half its value and causing panic, Jalbert’s clients didn’t lose a penny.

As if all of these accomplishments were not enough, Jalbert is also an accomplished radio personality and author. The Jalbert Financial Forum airs on WMUZ 103.5 Saturdays from 2 to 3 p.m.

Jalbert has also written several books covering a wide range of issues. His first book, “Giving: Philanthropy For Everyone,” was published in 2003 and raised $125 million. His most recent book, “Rescue Your Retirement,” offers readers all of the new methods and strategies that are keeping his clients in good fiscal health.